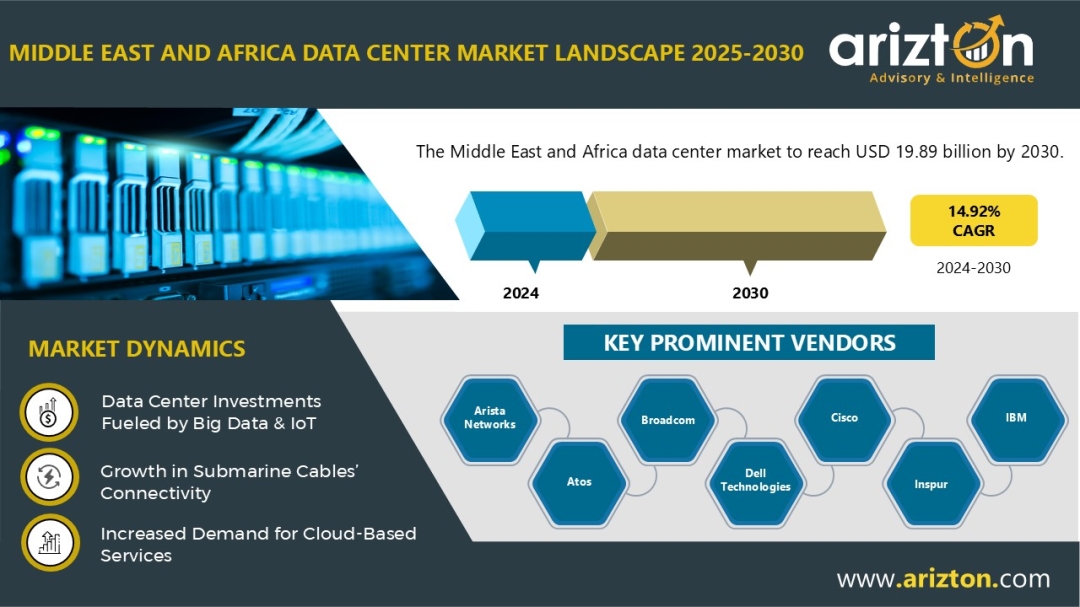

Middle East and Africa Data Center Market Investment to Reach $19.89 Billion by 2030 – Exclusive Research Report by Arizton

According to Arizton’s latest research report, Middle East and Africa data center market is growing at a CAGR of 14.92% during 2024-2030.

???

To Know More, Click: https://www.arizton.com/market-reports/middle-east-africa-data-center-market

Report Summary???????????????

Market Size - Investment (2030): $19.89 Billion???

Market Size – Investment (2029): $8.63 Billion??

CAGR – Investment (2024-2030): 14.92%

Market Size – Area (2030): 4,233 Thousand Sq. Ft.

Power Capacity (2030): 975 MW

Historic Year: 2021-2023

Base Year: 2024

Forecast Year: 2025-2030

Market Segmentation: Infrastructure, IT Infrastructure, Electrical Infrastructure, Mechanical Infrastructure, Cooling Systems, Cooling Techniques, General Construction, Tier Standard, and Geography

Geographical Analysis: Middle East (UAE, Saudi Arabia, Israel, Oman, Qatar, Jordan, Bahrain, Kuwait, and Other Middle Eastern Countries) and Africa (South Africa, Kenya, Nigeria, Egypt, and Other African Countries)

Market Overview

In 2024, the Middle East and Africa (MEA) data center market saw significant investments, driven by key players such as Khazna Data Centers, Africa Data Centres, Gulf Data Hub, Equinix, and Digital Realty, among others. Hyperscalers like Amazon Web Services (AWS), Google, and Microsoft are also expanding their presence in the region, with Microsoft completing a new data center in Saudi Arabia in December 2024.

The increasing adoption of AI by enterprises is fueling the demand for data processing, prompting operators to invest in AI-ready data centers. For example, iXAfrica Data Centre launched a new hyperscale facility designed with on-chip cooling solutions to support AI deployments.

In terms of data center destinations, the UAE, Saudi Arabia, and Israel are key hubs in the Middle East, while South Africa remains a leading destination in Africa. Emerging data center markets in the MEA region include Kenya, Nigeria, Qatar, Oman, Bahrain, Kuwait, and Egypt, reflecting the growing demand for data infrastructure across the region.

5G Deployment and Its Impact on Data Center Growth in MEA

In 2024, the MEA region witnessed a rapid expansion of 5G networks, driving significant growth in edge data center investments. Sub-Saharan Africa led globally with 18 new 5G launches across 13 countries, accounting for 39% of global deployments. Countries like the UAE, Saudi Arabia, Ghana, Kenya, and Nigeria are advancing 5G infrastructure through strategic partnerships with major tech firms like Ericsson, Huawei, and Nokia. This growth supports applications such as IoT, telemedicine, and smart agriculture, enhancing digital inclusion and economic development. The convergence of 5G and edge computing is transforming the region into a hub for next-generation digital connectivity.

Smart City Growth to Accelerate Data Center Demand in MEA

The development of smart cities across the Middle East and Africa (MEA) is significantly driving demand for advanced technologies and data center infrastructure. The region's strategic position for undersea cable landings enhances global connectivity, supporting large-scale smart city projects. As cities like Dubai, Abu Dhabi, Riyadh, and Cairo prioritize digital infrastructure, the surge in data generation fuels the need for edge data centers and High-Performance Computing (HPC). Ranked among the top 20 in the IMD Smart City Index 2024, Abu Dhabi and Dubai exemplify MEA’s tech-forward vision. Initiatives like Digital Dubai's AI platform further boost investment opportunities in the data center market.

UAE and Saudi Arabia Lead Data Center Growth in the Middle East

The UAE remains a well-established hub for data center development in the Middle East, with major investments in 2024 from operators like Equinix, Gulf Data Hub, and Khazna Data Centers, primarily in Dubai and Abu Dhabi. In a notable development, the Sharjah Communication Technology Authority (SCTA) signed an MoU with BEEAH and Khazna to establish new data centers in Sharjah, enhancing the region’s digital infrastructure. Saudi Arabia, the region’s second-largest data center market, is also experiencing rapid growth, driven by its cloud-first strategy. In 2024, Oracle launched a second cloud region in Riyadh, while AWS announced a $5.3 billion investment to establish a new cloud region with three availability zones by 2026.

Expanding Operator Landscape Boosts Growth in MEA Data Center Market

The Middle East and Africa (MEA) data center market hosts a diverse mix of global and local operators, including key players such as Khazna Data Centers, Gulf Data Hub, Equinix, Digital Realty, center3 (stc), and Africa Data Centres. The market is also attracting new entrants like Agility, Pure Data Centres, Qareeb Data Centres, and Desert Dragon Data Centers, reflecting its growing appeal. Additionally, global cloud giants such as AWS, Google, Microsoft, Oracle, and Alibaba Cloud are expanding their presence by developing dedicated cloud regions across MEA to meet rising demand for cloud services and digital infrastructure.

?

Buy this Research @ https://www.arizton.com/market-reports/middle-east-africa-data-center-market

The Report Includes the Investment in the Following Areas:

Infrastructure

- IT Infrastructure

- Electrical Infrastructure

- Mechanical Infrastructure

- General Construction

IT Infrastructure

- Server Infrastructure

- Storage Infrastructure

- Network Infrastructure

Electrical Infrastructure

- UPS Systems

- Generators

- Transfer Switches & Switchgear

- Power Distribution Units

- Other Electrical Infrastructure

Mechanical Infrastructure

- Cooling Systems

- Racks

- Other Mechanical Infrastructure

Cooling Systems

- CRAC & CRAH Units

- Chiller Units

- Cooling Towers, Condensers, and Dry Coolers

- Economizers & Evaporative Coolers

- Other Cooling Units

Cooling Techniques

- Air-based

- Liquid-based

General Construction

- Core & Shell Development

- Installation & Commissioning Services

- Engineering & Building Design

- Physical Security

- Fire Detection & Suppression

- DCIM

Tier Standard

- Tier I & II

- Tier III

- Tier IV

Geography

Middle East

- UAE

- Saudi Arabia

- Israel

- Oman

- Qatar

- Jordan

- Bahrain

- Kuwait

- Other Middle Eastern Countries

Africa

- South Africa

- Kenya

- Nigeria

- Egypt

- Other African Countries

Vendors

Key Data Center IT Infrastructure Providers

- Arista Networks

- Atos

- Broadcom

- Cisco

- Dell Technologies

- Fujitsu

- Hewlett Packard Enterprise

- Hitachi Vantara

- Huawei Technologies

- IBM

- Inspur

- Lenovo

- NetApp

Key Data Center Support Infrastructure Providers

- 4Energy

- ABB

- Airedale

- Alfa Laval

- Canovate

- Caterpillar

- Cummins

- Daikin Applied

- Delta Electronics

- EAE Group

- Eaton

- Enrogen

- Envicool

- EVAPCO

- Generac Power Systems

- HITEC Power Protection

- Johnson Controls

- Legrand

- Master Power Technologies

- Mitsubishi Electric

- Piller Power Systems

- Rittal

- Rolls-Royce

- Schneider Electric

- Siemens

- STULZ

- Vertiv

Key Data Center Contractors

- Abbeydale

- AECOM

- ALEC Data Center Solutions

- ALDAR

- Al Latifia Trading & Contracting

- Anel Group

- Arup

- Ashi & Bushnag

- ASU

- AtkinsRealis

- AuerbachHaLevy Architects

- Azura Consultancy

- b2 Architects

- Black & White Engineering

- CAP DC

- Capitoline

- Chess Enterprises

- Copycat Group

- Core Emirates

- DAR Group

- Datalec Precision Installations

- DC PRO Engineering

- Deerns

- DMC Global Partners

- Eastra Solutions

- Edarat Group

- EDS Engineers

- EGEC

- Egypro

- Electra

- ENMAR Engineering

- Group AMANA

- H&MV Engineering

- Harinsa Qatar

- HATCO

- HHM Group

- Hill International

- ICS Nett

- Ingenium

- Interkel

- INT’LTEC

- ISG

- JAMED

- James L. Williams (JLW)

- John Paul Construction

- JLB Architects

- Laing O’Rourke

- Laith Electro Mechanical

- Linesight

- M+W Group (Exyte)

- Mace

- McLaren Construction Group

- MEC - Margolin Bros. Engineering & Consulting

- Mercury

- Middle East Modern Architecture (MEMA)

- MIS

- NDA Group

- Orascom Construction

- Prota Engineering

- PTS

- Qatar Site & Power

- Raghav Contracting

- REDCON Construction

- RED Engineering Design

- Raya Network Services

- RW Armstrong

- RoyalHaskoningDHV

- SANA Creative Systems

- Shaker Group

- Scientechnic

- Site & Power DK

- Sterling and Wilson

- Sudlows

- Summit Technology Solutions

- Telal Engineering & Contracting

- Tri-Star Construction

- Turner & Townsend

- UBIK

- United For Technology Solutions

- Westwood Management

Key Data Center Investors

- 21st Century Technologies

- Adgar Investments and Development

- Africa Data Centres

- Airtel Africa

- Amazon Web Services (AWS)

- Batelco

- Bynet Data Communications

- center3 (stc)

- Compass Datacenters

- Digital Parks Africa

- Digital Realty

- EdgeConneX

- Equinix

- Galaxy Backbone

- Global Technical Realty

- Gulf Data Hub

- Huawei Technologies

- iXAfrica Data Centre

- Khazna Data Centers

- MedOne

- MEEZA

- Microsoft

- Mobily

- Moro Hub

- N+ONE

- NTT DATA

- Oman Data Park

- Ooredoo

- Open Access Data Centres

- Oracle

- PAIX

- Paratus Namibia

- Quantum Switch

- Rack Centre

- Raxio Data Centres

- Raya Data Center

- Serverfarm

- Telecom Egypt

- Telehouse

- TONOMUS

- Turkcell

- Turk Telekom

- Vantage Data Centers

- Wingu.Africa

New Entrants

- Agility

- Anan

- Cloudoon

- DataVolt

- Desert Dragon Data Centers

- Kasi Cloud

- NED

- Pure Data Centres

- Qareeb Data Centres

- Sahayeb Datacenters

- Serverz Data Center

- Techtonic

??

Key Questions Answered in the Report:???????????????

How big is the Middle East and Africa data center market?

What is the growth rate of the Middle East and Africa data center market?

What is the estimated market size in terms of area in the Middle East and Africa data center market by 2030?

How many MW of power capacity is expected to reach the Middle East and Africa data center market by 2030?

What are the key trends in the Middle East and Africa data center market?

Why Arizton????????????????

100%?Customer Satisfaction???????????????

24x7?availability – we are always there when you need us???????????????

200+?Fortune 500 Companies trust Arizton's report???????????????

80%?of our reports are exclusive and first in the industry???????????????

100%?more data and analysis????????????????

1500+?reports published till date???????????????

???????????????

Post-Purchase Benefit???????????????

- 1hr of free analyst discussion?

- 10% off on customization?

???????????????

About Us:???????????????

Arizton Advisory and Intelligence is an innovative and quality-driven firm that offers cutting-edge research solutions to clients worldwide. We excel in providing comprehensive market intelligence reports and advisory and consulting services.????????????

We offer comprehensive market research reports on consumer goods & retail technology, automotive and mobility, smart tech, healthcare, life sciences, industrial machinery, chemicals, materials, I.T. and media, logistics, and packaging. These reports contain detailed industry analysis, market size, share, growth drivers, and trend forecasts.????????????

Arizton comprises a team of exuberant and well-experienced analysts who have mastered generating incisive reports. Our specialist analysts possess exemplary skills in market research. We train our team in advanced research practices, techniques, and ethics to outperform in fabricating impregnable research reports.????????????

Media Contact

Company Name: Arizton Advisory & Intelligence

Contact Person: Jessica

Email: Send Email

Phone: +1 3122332770

Country: United States

Website: https://www.arizton.com/market-reports/middle-east-africa-data-center-market

Press Release Distributed by ABNewswire.com

To view the original version on ABNewswire visit: Middle East and Africa Data Center Market Investment to Reach $19.89 Billion by 2030 - Exclusive Research Report by Arizton

Information contained on this page is provided by an independent third-party content provider. XPRMedia and this Site make no warranties or representations in connection therewith. If you are affiliated with this page and would like it removed please contact [email protected]