Global Straw Market Set to Reach USD 9.5 Billion by 2036 as Sustainability Mandates Redefine Production

Once a disposable item, straws are now a sustainability symbol as eco-friendly materials, plastic bans, and ESG goals reshape the global straw market.

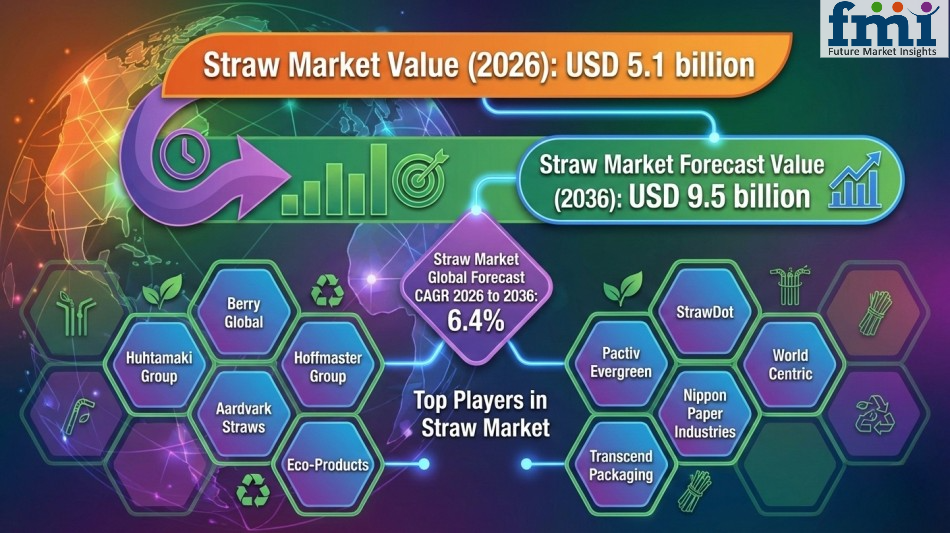

NEWARK, DELAWARE / ACCESS Newswire / February 11, 2026 / The global straw market is entering a decisive decade of transformation as sustainability mandates, shifting consumer preferences, and regulatory pressure reshape how drinking straws are produced, sourced, and consumed worldwide. Valued at USD 5.1 billion in 2026, the market is projected to reach USD 9.5 billion by 2036, expanding at a compound annual growth rate (CAGR) of 6.4%.

Once viewed as a low-value, disposable commodity, straws are rapidly becoming a strategic touchpoint in the global sustainability conversation particularly across foodservice, retail, and hospitality sectors. Buyers today are no longer driven solely by cost and convenience; instead, they are prioritizing eco-friendly materials, regulatory compliance, and brand alignment with environmental responsibility.

According to a comprehensive strategic outlook from Future Market Insights (FMI), the straw market's growth trajectory is closely tied to the global push to reduce single-use plastics, rising awareness of plastic pollution, and the accelerating adoption of biodegradable, recyclable, and reusable alternatives.

From Disposable Plastic to Sustainable Design: A Market Redefined

The straw market is undergoing a fundamental material shift. For decades, plastic straws dominated global consumption due to their low cost and ease of mass production. However, mounting evidence of plastic waste in oceans and landfills has triggered widespread bans and restrictions across North America, Europe, and parts of Asia-Pacific.

As a result, manufacturers are pivoting toward paper, bamboo, wheat-based, PLA (polylactic acid), and metal straws, transforming the industry's cost structures and innovation priorities. Production economics are evolving as companies balance sustainability goals with durability, performance, and scalability.

This shift has elevated straws from a peripheral product to a symbol of corporate sustainability commitments, especially for global foodservice chains and beverage brands seeking to strengthen ESG credentials.

Market Metrics at a Glance

Market Metric | Value / Detail (2026-2036) |

|---|---|

Market Value (2026) | USD 5.1 Billion |

Forecast Value (2036) | USD 9.5 Billion |

Global Growth Rate (CAGR) | 6.4% |

Leading Application Segment | Food Service (48% Share) |

Leading Material Type | Paper Straws (39% Share) |

Top Growth Market | China (7.6% CAGR) |

Growth Outlook: Early Momentum, Long-Term Stability

Between 2026 and 2031, the straw market is expected to grow from USD 5.1 billion to USD 7.5 billion, adding USD 2.4 billion in value. This phase will be marked by accelerated adoption of eco-friendly alternatives as regulatory bans on plastic straws expand and consumer awareness peaks.

From 2031 to 2036, the market will grow further to USD 9.5 billion, though at a slightly moderated pace. As sustainable straws become mainstream and penetration levels rise, growth will stabilize. However, continued material innovation, improved product performance, and broader acceptance in emerging markets will sustain long-term expansion.

Segment Spotlight: Paper Straws and Food Service Dominate

Paper Straws: The Leading Material

Paper straws account for 39% of the global market, making them the dominant material segment. Their biodegradability, compostability, and regulatory acceptance position them as the preferred alternative to plastic, particularly in regions with strict environmental laws.

Ongoing advancements in paper treatment and manufacturing have addressed early concerns around durability and moisture resistance, further accelerating adoption. As bans on plastic straws widen, paper-based solutions are expected to retain their leadership position.

Food Service: The Primary Application

The food service sector commands 48% of total straw demand, driven by extensive use in restaurants, cafes, bars, and quick-service outlets. Regulatory pressure and consumer scrutiny have pushed foodservice operators to rapidly transition to sustainable options such as paper, bamboo, and PLA straws.

For global chains, straw selection has become a visible indicator of environmental responsibility, reinforcing demand for certified, eco-friendly products.

Regional Powerhouses: Asia-Pacific Leads Growth

While North America and Europe remain high-value, regulation-driven markets, the fastest growth is occurring in Asia-Pacific, supported by population scale, expanding foodservice industries, and rising environmental awareness.

China (7.6% CAGR): As both a manufacturing hub and consumption powerhouse, China is aggressively transitioning away from single-use plastics. Government initiatives and urban consumer awareness are driving strong demand for biodegradable and paper straws.

India (7.3% CAGR): Rapid urbanization, expanding hospitality infrastructure, and policy measures to curb plastic waste are fueling steady growth in eco-friendly straw adoption.

United States (7.0% CAGR): The U.S. market is defined by declining plastic straw usage, strong foodservice demand, and innovation in sustainable materials.

Germany (6.2% CAGR): Strict environmental regulations and high consumer sustainability awareness continue to drive adoption of biodegradable and reusable straws.

Japan (5.9% CAGR): Government-led plastic reduction initiatives and eco-conscious consumer behavior support consistent market growth.

Key Market Dynamics: Drivers and Restraints

Growth Drivers

Regulatory bans on single-use plastic straws

Rising consumer preference for sustainable products

Expansion of global foodservice and beverage outlets

Corporate ESG commitments and sustainable packaging strategies

Technological improvements in biodegradable materials

Market Restraints

Volatility in raw material supply due to agricultural yield fluctuations

Higher production costs of paper and biodegradable straws versus plastic

Limited composting and recycling infrastructure in some regions

Regulatory inconsistencies across global markets

Emerging Trends Shaping the Next Decade

Looking toward 2036, several trends are expected to redefine competitive positioning in the straw market:

Eco-Friendly Innovation: Increased use of compostable biopolymers, agricultural residues, and reusable materials such as metal and silicone.

Performance-Focused Design: Enhanced durability, heat resistance, and beverage compatibility to improve user experience.

Branding & Transparency: Clear labeling on material origin, biodegradability, and lifecycle impact to appeal to environmentally conscious consumers.

Digital & Direct Sales Channels: Growth of e-commerce and direct-to-business platforms enabling niche and specialty straw products to reach global buyers.

Supply Chain Traceability: Adoption of transparency tools to align with sustainable sourcing and regulatory compliance.

Competitive Landscape: Sustainability as a Differentiator

The global straw market is highly competitive, with sustainability serving as the primary battleground. Huhtamaki Group leads the market through its broad portfolio of paper and fiber-based straw solutions aligned with global regulations.

Other key players, including Berry Global, Hoffmaster Group, Aardvark Straws, Eco-Products, StrawDot, Pactiv Evergreen, Nippon Paper Industries, Transcend Packaging, and World Centric-are strengthening their positions through material innovation, scale efficiencies, and compliance-driven product development.

Tier-1 manufacturers are leveraging long-term foodservice contracts and global distribution networks, while smaller players are carving niches with premium, reusable, or specialty eco-friendly straws.

Outlook

As sustainability moves from aspiration to obligation, the straw market is poised for sustained, regulation-driven growth. Companies that successfully align material innovation, cost management, and environmental compliance will define market leadership through 2036 transforming a once-overlooked product into a cornerstone of the global sustainable packaging ecosystem

For an in-depth analysis of evolving formulation trends and to access the complete strategic outlook for the Straw Market through 2036, visit the official report page at: https://www.futuremarketinsights.com/reports/straws-market

Related Reports:

Straw Paper Market - https://www.futuremarketinsights.com/reports/straw-papers-market

Metal Straw Market - https://www.futuremarketinsights.com/reports/metal-straws-market

Bamboo Straw Market - https://www.futuremarketinsights.com/reports/bamboo-straws-market

Compostable Straws Market - https://www.futuremarketinsights.com/reports/compostable-straws-market

Canada Straws Market - https://www.futuremarketinsights.com/reports/canada-straws-market

About Future Market Insights (FMI)

Future Market Insights (FMI) is a leading provider of market intelligence and consulting services, serving clients in over 150 countries. Headquartered in Delaware, USA, with a global delivery center in India and offices in the UK and UAE, FMI delivers actionable insights to businesses across industries including automotive, technology, consumer products, manufacturing, energy, and chemicals.

An ESOMAR-certified research organization, FMI provides custom and syndicated market reports and consulting services, supporting both Fortune 1,000 companies and SMEs. Its team of 300+ experienced analysts ensures credible, data-driven insights to help clients navigate global markets and identify growth opportunities.

For Press & Corporate Inquiries

Rahul Singh

AVP - Marketing and Growth Strategy

Future Market Insights, Inc.

+91 8600020075

For Sales - [email protected]

For Media - [email protected]

For web - https://www.futuremarketinsights.com/

SOURCE: Future Market Insights, Inc.

Information contained on this page is provided by an independent third-party content provider. XPRMedia and this Site make no warranties or representations in connection therewith. If you are affiliated with this page and would like it removed please contact [email protected]